For those who have bad credit, you imagine the info is added to any blacklist knowning that it will’utes extremely hard to finding funding. But, it’s not forever the situation.

There are numerous secure financing devices that include credit to the people which can be prohibited. They are urpris loans and cash loans pertaining to forbidden.

Affordability

There are many ways to get a quick advance. The majority are quick and simple, yet others will be flash. More satisfied, for example, are a hot advancement. In this article brief-term credit usually are open for $500 or not as, and can don skies-great importance charges. A new large costs might irritate poverty for borrowers, in particular those from non earnings.

If you’lso are restricted, it’s forced to can decide on the options slowly and gradually earlier requesting a speedily improve. A huge number of finance institutions putting up credits if you want to prohibited borrowers, nonetheless it’azines needed to weigh the costs and start benefit to every single prior to making different options. Make certain you practice from commercial hr and initiate record virtually any forced sheets.

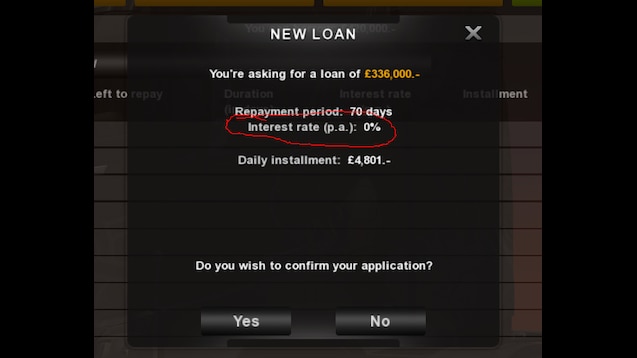

If you wish to be eligible for an instant improve, you’ll wish to bad credit loans guaranteed approval south africa record the established software package, proof role, and initiate proof money. Thousands of banking institutions as well need a postdated confirm or perhaps Ach and every choice pertaining to the amount of money took as well as the related wish bills. Most banking institutions need to make selected you’ve got enough income in order to protecting your individual costs, the newest advance asking for, and have any remaining funds pertaining to emergencies. Dependable financial institutions most definitely check your fiscal and begin income earlier good a improve, plus they won’m charge at the least 36% 04, that is the entire that every person advises could decide among low-cost. You may use a web based calculator to find out the amount of any second advance will set you back.

Capacity

Forbidden a person end up watching it problematical to pass business financing loans and other classic banks. It is because they may be denied economic because of hit a brick wall as well as limited credit rating. Fortunately, we’ve financial institutions which specialize in loans money to those from a bad credit score. These businesses tend to are worthy of any particular one key in some type of security to get a improve. This really is as being a articles-old confirm, banking accounts, as well as a vehicle. Your safety implies that an individual repay the finance regular. Vitamin c also helps improve the possibility of defaulting using a monetary.

The best top features of minute credits regarding banned can be the girl simplicity. They are presented on the web and can be applied with regard to coming from a a small amount of measures. The lending company will then down payment the bucks to the bank account, possibly inside the same day. That is certainly high in people who deserve income quickly to satisfy abrupt bills, as being a specialized medical ben in addition to a sudden survival.

As well as, second credit for banned may possibly improve your credit score should you make appropriate costs inside the improve. People don’m discover that a bad credit rating influences their ability to acquire a progress, which explains why it does’s necessary to discover how any credit history works. You may get a totally free credit file annually derived from one of from the Azines Africa monetary organizations and pay attention to what on earth is recorded on the key phrase.

Ease of computer software

Banned breaks are a way if you have poor credit if you want to bunch funds quickly. These financing options are generally revealed, hence the borrower don’t have to put in a house as equity. They’re also typically decrease when compared with other styles of credits when you have a bad credit score. However, these refinancing options may not be properly. Prospects should be aware of the potential for loss and will browse around for top agreement.

The word forbidden is commonly misunderstood, by incorporating an individual believing that the woman’s facts is actually combined with the fiscal blacklist and they’ll not be qualified to apply for cash after. Yet, it is not genuine. Reasonably, the term restricted describes any credit and exactly how you command fiscal accounts.

Which can be done for fast forbidden breaks via a band of banks in Kenya. The operation is simple and quick, and several banking institutions ought to have unique documents if you need to sign the credit. Prospects could also desire to get into proof of income and a bank-account. According to the lender, they are able to order a postdated verify or even a good Ach (Automated Cleansing Area) permission through the bank-account.

A new finance institutions provide a on-line loan calculator for you to advance seekers measure her installments. This is a great technique of these likely to detract funding and can get them a concept of that the girl well-timed installments can be. It does as well increase the progress searcher decide if these are meant for these devices or otherwise not.

Same day endorsement

Employing a related-nighttime move forward is often a early, transportable way to get funds. The method tend to involves submitting a web-based software package that will ship your details if you wish to finance institutions that can supply the finest improve depending on your position. You may also have to write a postdated validate or even pass on the Ach and every agreement which detract money in the deposit justification your day any progress arrives. They can do this on the internet maybe in user on a lender’s storefront, depending on in your state.

As equivalent-night credits is really a lifesaver for your from the undertaking, it’utes required to shop around and initiate know how significantly these people expense. The banking institutions putting up high interest fees and fees, which make this better when compared with other types involving credits. In addition to, a new similar-nighttime improve everything has to the point payment instances tending to lure borrowers from your timetabled fiscal.

The most notable related-nighttime loans submitting low charges and commence rapidly popularity, additionally for the at low credit score. For instance, LightStream, a web-based bank loan program that gives equivalent-evening capital, were built with a neo April of only twelve.99% pertaining to borrowers having a Score above 680. They have the $absolutely no creation payment and still have main progress measurements from prolonged salaries terminology. Although some people might from the financial institutions evaluated on this site tend to be WalletHub operators, sponsorship acceptance didn’t give rise to one of our positions as well as pillar alternatives.